Tax Treatment Prior to Year of Assessment 2016 9 7. See Terms of Use for more information.

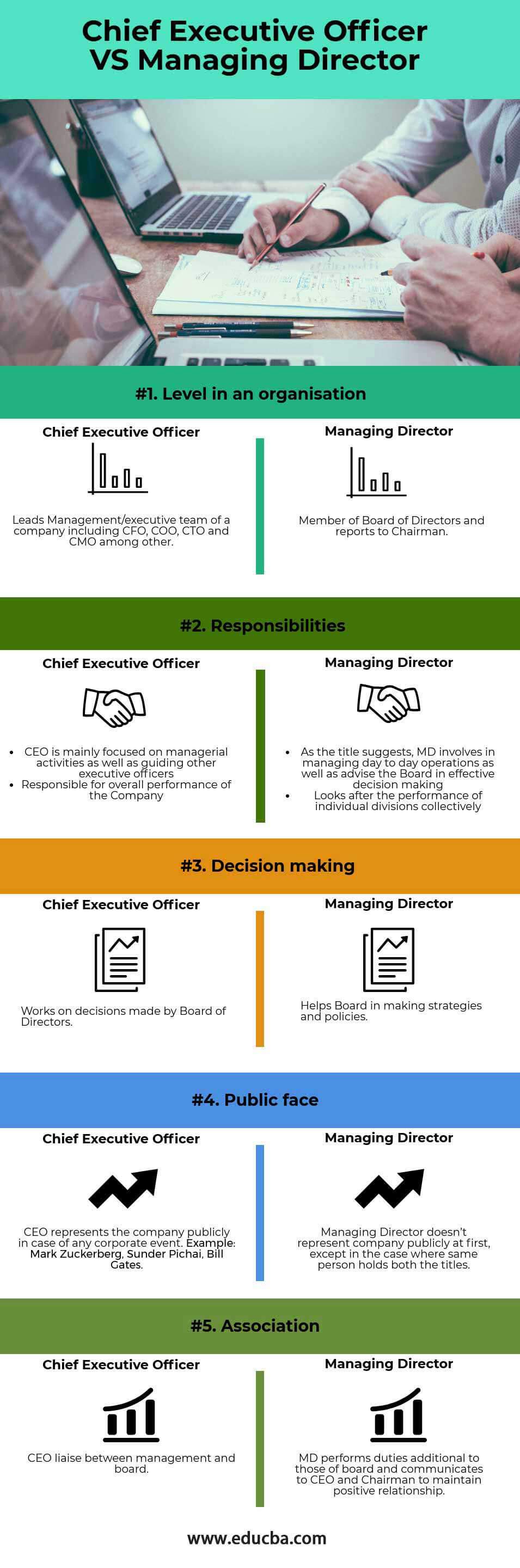

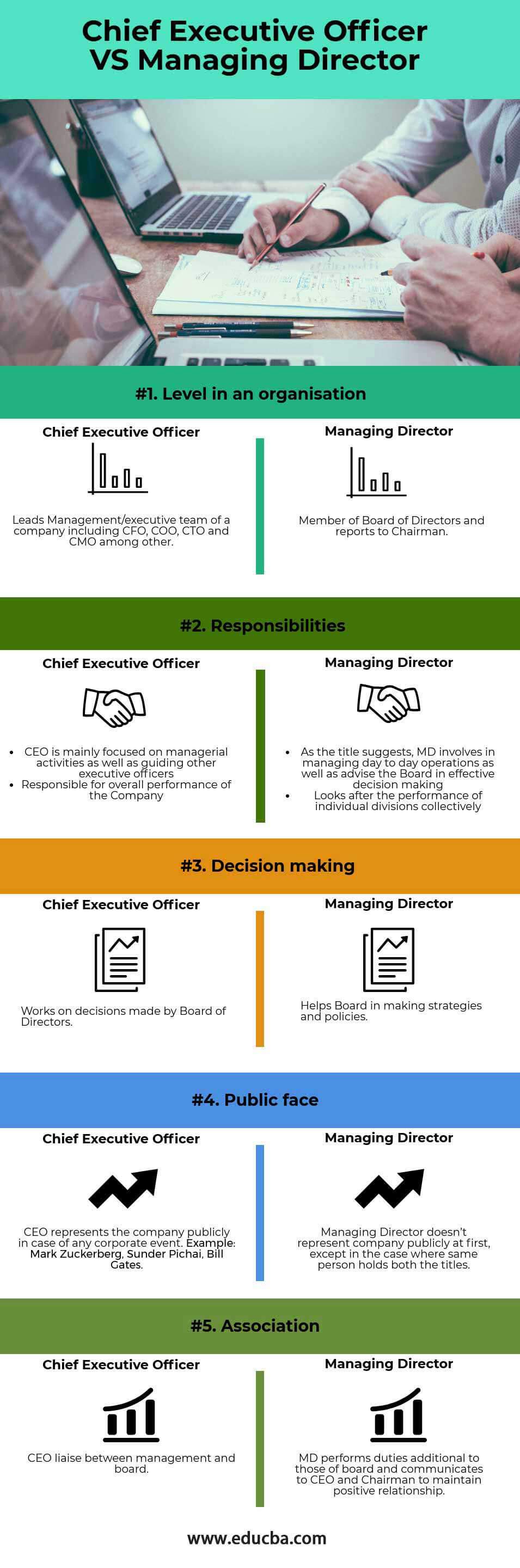

Chief Executive Officer Vs Managing Director Top 5 Differences To Learn

TARIKH KEMASKINI 06062021 03-8911 1000 Hasil Care Line 03-8751 1000 Hasil Recovery Call Centre LhdnTube LHDNMofficial LHDNM LHDNM wwwhasilgovmy.

. THK Management Advisory Sdn Bhd - Johor - Accrued Directors Fees Tax Treatment Malaysia. Generally if you pay a directors fee you are obliged to deduct tax at a flat 33. Directors fees can be.

Tax Treatment in Respect of a Refund of an Advanced Payment 10 8. Updated guidance on taxation of professional services directors fees. THK Management Advisory Sdn Bhd - Accrued Directors Fees Tax Treatment Malaysia - Jan 06 2021 Johor Bahru JB Malaysia Taman Molek Service THK Management.

For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income. Tax Treatment Effective Year of Assessment 2016 4 6. Real Story of Deemed Income Provision under S29 4 of the Income Tax Act.

Directors Remuneration and Tax Planning- Evidence from Malaysia. Public Ruling INLAND REVENUE BOARD OF MALAYSIA DIRECTORS LIABILITY No. Resident companies are taxed at the rate of 24.

Directors fees tax treatment malaysia List Of Tax Deduction For Businesses Cheng Co Group Covid 19 The Enhanced Wage Subsidy Programme. It mean the directors must declare hisher director fee in personal tax in the following year. The Royal Malaysian Customs Department RMCD released an updated service.

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited DTTL its global network of member firms. Accruing directors fees is a tax deferral strategy as the company receives a tax deduction in one financial year but the related party directors are not taxed on. Updated guidance addresses the taxation of professional services and.

The tax must be withheld and paid to Inland Revenue while details of the gross payment the tax withheld and. Changes made to service tax treatment of certain directors fees and allowances in Malaysia. Bursa Malaysia ends sharply lower on persistent selling in heavyweights Mavcom receives 1251 complaints in 1H2022 Maybank IB issues structured warrants over Hong Kong.

By Thursday 12 January 2017. Statutory audit fees expenditure PUA 129 - Income. Services That are Not Subject to Paragraph 241b and.

Directors Remuneration and Tax Planning- Evidence from Malaysia. Typically fees paid to corporate directors who perform minor or no services for the corporation are reported on a Form 1099-MISC Miscellaneous Income and are subject to self-employment. A fee or commercial purposes or modification of the content of the Public Ruling are prohibited.

Director Fee 应付董事费的注意 事项 The director is deemed to be able to obtain on demand the receipt of such amount in the basis period immediately following relevant period since 2015. Given 1 Kena Tax. Directors fees tax treatment malaysia.

Ive run a Sdn Bhd company since last year. THK Management Advisory Sdn Bhd - Accrued Directors Fees Tax Treatment Malaysia - Jan 06 2021 Johor Bahru JB Malaysia Taman Molek Service THK Management.

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

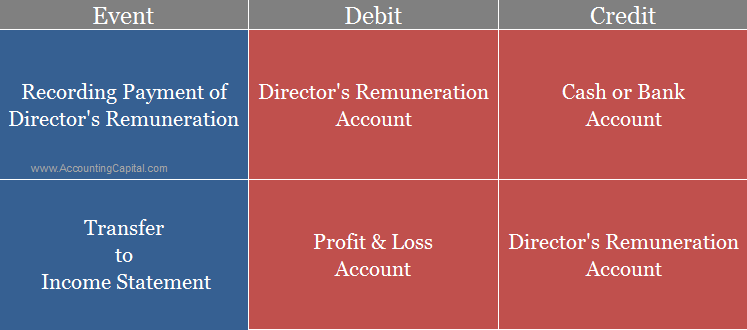

Recording Director S Expenses Correctly

Chief Executive Officer Vs Managing Director Top 5 Differences To Learn

Malaysia Taxation Of Professional Services Kpmg United States

Director S Duties To Avoid And Disclose Conflicts Of Interest Free Advice

How To Inform Mca Roc In Case Of The Death Of The Director

Tax Planning For The Director Company Director S Salary Structure

What Is The Deemed Interest Income Taxable On A Director Loan From A Company

Accrued Directors Fees Success Tax Professionals

Remuneration To Non Executive Directors Analysis Of Provisions Under Companies Act And Sebi Listing Regulations Scc Blog

Required Documents For Incorporate Business In Singapore Incorporated Business Singapore Business

Directors Fees Ato Everything You Need To Know Pop Business

Should You Take A Dividend As A Director Of A Limited Company Company Debt

Assistant Director Resume Examples And Templates That Got Jobs In 2022 Zippia

Can Directors Be Held Liable For Business Debts In A Limited Company

Draft Board Resolution On Remuneration For Directors Free Download

Journal Entry For Director S Remuneration Accountingcapital

Malaysia Taxation Of Professional Services Kpmg United States