There are a few factors that determine your eligibility and may differ from bank to bank. Loan amount The amount of money you borrow your principal loan amount has a big influence.

Best Housing Loans In Malaysia 2022 Compare And Apply Online

Credit Card Funds Transfer to any Standard Chartered Credit Card Personal Credit Home Renovation Loan Personal Loan Overdraft and Mortgage accounts is not permitted.

. How much loan could I borrow. About home loan specialists. Interest rates for housing loans in Malaysia are usually quoted as a percentage below the Base Rate BR.

Interest Rate pa 0 15. Monthly net income after income tax EPF and SOCSO Existing Monthly Debt Repayment other mortgages personal loans and hire purchases. Home Loan eligibility is dependent on factors such as your monthly income current age credit score fixed monthly financial obligations credit history retirement age etc.

Find out the savings in EMI. Get lower interest rates and additional top-up loans of up to Rs. You can repay your loan on a monthly basis via Interbank GIRO IBG cash deposit cheque deposit or MEPS ATM fund transfer.

Login to online banking. Car Loan Approval Process. The information provided on this website is for general education.

Borrow up to 75. If you wish to take up asset acquisition then you can consider applying for a term loan. By taking up this loan this individual is tied down to a formal written agreement where the borrower car buyer is indebted to pay the loan amount plus interest to the lender banks financial agents etc over a specified period of time.

As a rule of thumb a borrower can typically borrow up to four times hisher monthly salary. How much time will it take for my loan to be approved. Find out how much you can borrow with our home loan calculator more.

A personal loan is an amount of money you can borrow to use for a variety of purposes. Borrow up to 75 of the cost to build or enhance your dream home. 50 Lacs when you move your outstanding home loan balance to HDFC.

For auto service financing we provide a 3 and 6 times monthly instalment for up to RM5000. For private sector personal loan you can borrow up to RM20000 with loan terms between 1 and 4 years. For this loan you will be able to withdraw in excess of your current account balance to an approved limit.

You pay back only what you borrow. Tenure Years 1 30. The loan can be repaid over a period of 12 to 60 months.

For instance you may use a personal loan to consolidate debt pay for home renovations or plan a dream wedding. For essential goods and services we offer loans of up to 2000. Here are some of the primary variables that can impact how much you will pay over the life of the loan.

To speed up the approval of your car loan application you can observe these tips before or during your car. Get the peace of mind by knowing all the details about your loan using HDFC Home Loan Eligibility Calculator. Enjoy significant savings with Eco-Care Car Loan.

Your loan will be disbursed within 10. For example if the current BR rate is 400 Update. However your salary also plays a part in determining the loan amount that you qualify for.

Get your loan approved in 60 seconds before visiting the showroom. We offer two No Interest Loan products. A car loan in Malaysia is a type of loan that is taken by an individual for the sole reason of buying a car.

We shall also be entitled to withdraw the Promotional Interest Rate and charge applicable finance charges andor late payment charges at such rate as we may determine. We have stores in Queensland Victoria and South Australia. The loan will be granted for a period of time and shall be repaid in monthly instalments.

Pretty much the same as any other loan applications car loan approval process will depend on your income employment type current financial commitments debt service ratio and some other lifestyle factors. NILs is a smart budgeting solution to help you pay for lifes essentials. The highest loan amount you can borrow through a personal loan in Malaysia is RM200000 depending on the financial institutions.

For vehicles loans of up to 5000. Borrow up to 7 years and 70 of the purchase price or our valuation of the car whichever is lower. As of 2nd January 2015 Base Lending Rate BLR has been updated to Base Rate BR to reflect the recent changes made by Bank Negara Malaysia and subsequently by major local banks the interest rate on a BR.

This calculator helps you estimate your home loan eligibility and what is the maximum amount you can borrow.

![]()

Getting Your Finance In Order When Applying For A Home Loan Kinta Properties

What Happens To Your Home Loan If You Lose Your Job

Home Loan Process In 2022 Simplified Home Loan Application Process

Buying A Home How Much Am I Able To Borrow Home Buying The Borrowers Home Loans

How Much Home Loan Can You Get Based On Your Salary In Malaysia

How Much Can You Borrow Based On Your Dsr

I Have A Home Loan On My House Which I Want To Sell What Is The Process Mint

Home Loan For Retired People 5 Things To Keep In Mind Before Applying

Best Housing Loans In Malaysia 2022 Compare And Apply Online

Home Loan Calculator New Property Launch

Applying For A Housing Loan In Malaysia 6 Important Things To Know

Everything You Need To Know About Getting A Mortgage Loan For Property In Malaysia Airmas Group

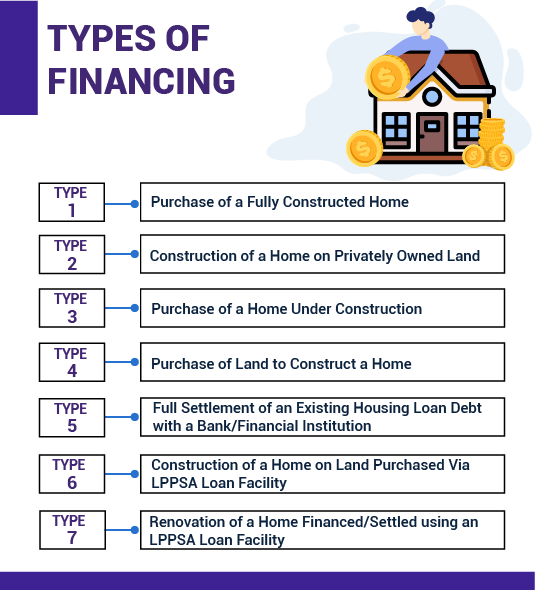

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan Public Sector Home Financing Information

Home Loan Eligibility Affordability Calculator

Home Loan Home Loan Calculator Hong Leong Bank

Joint Home Loan The Ultimate Guide Properly

![]()

Home Loans In Rwanda Mortgages In Rwanda I M Bank Rwanda

Home Loan Eligibility Calculator Check Housing Loan Eligibility Kotak Bank